If you're thinking about investing in a savings bond, you may be wondering how much your $100 bond will be worth after 15 years. The answer depends on several factors, such as the interest rate and the type of bond you have. In this article, we'll explore the various factors that can affect the value of your $100 savings bond after 15 years and provide tips on how to maximize its worth. Let's dive in!How much is a 100 dollar savings bond worth after 15 years?

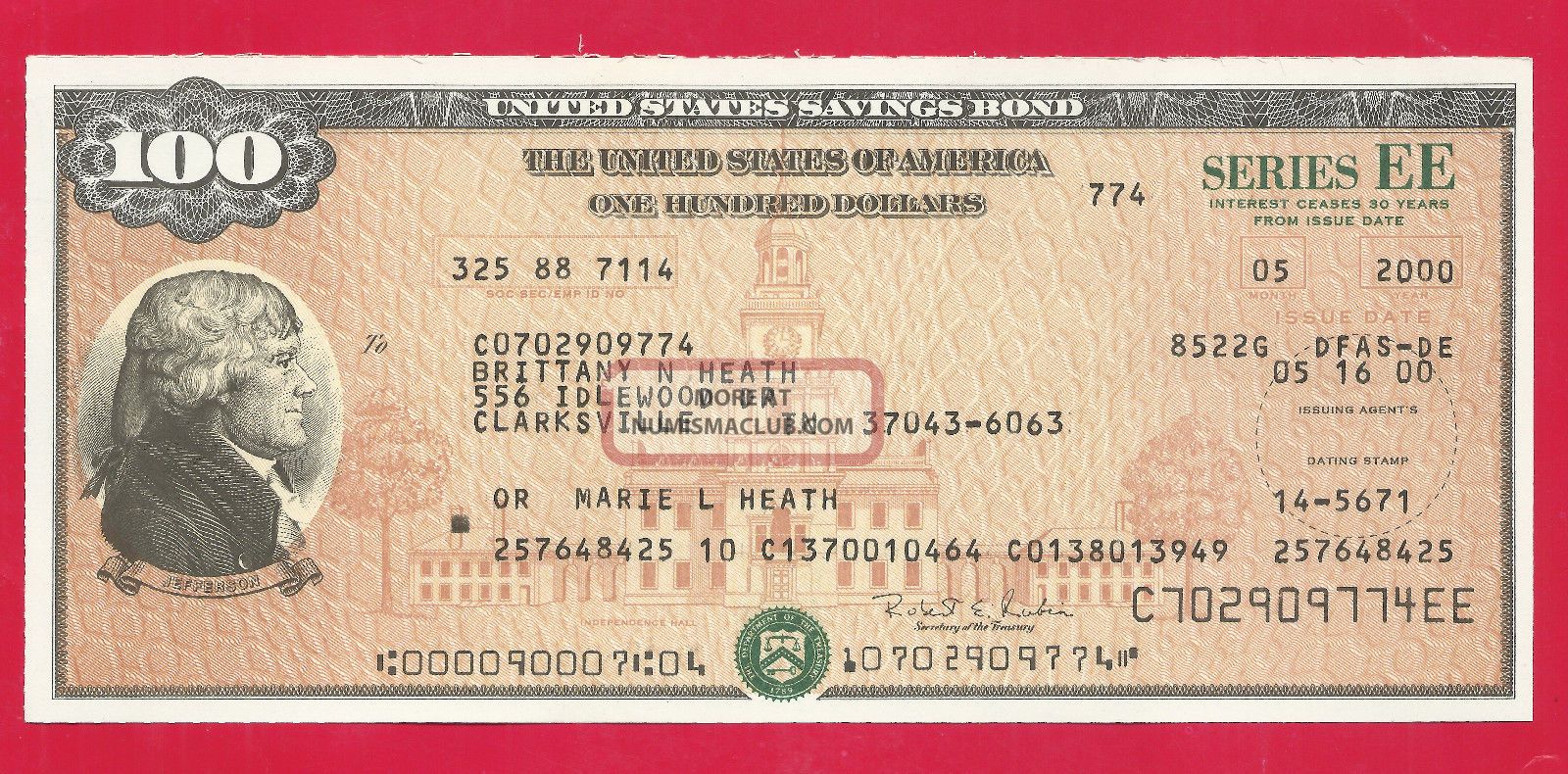

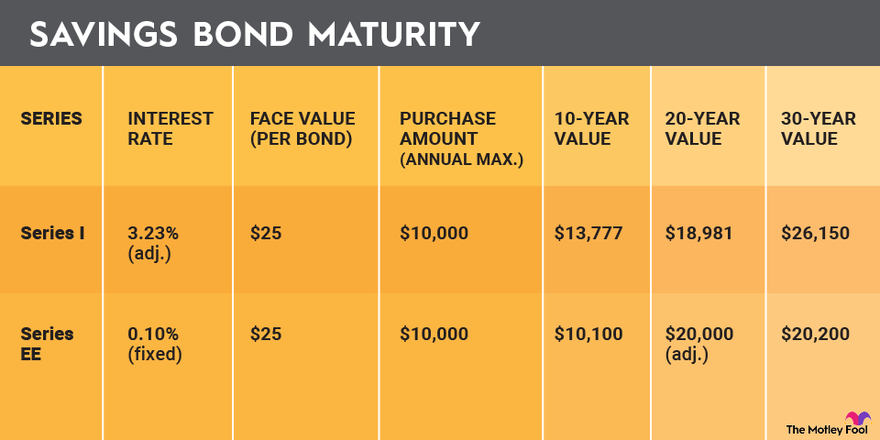

The value of a $100 savings bond after 15 years can vary greatly depending on the bond's interest rate and maturity period. For example, a Series EE savings bond with a fixed interest rate of 0.10% will have a value of approximately $130 after 15 years. However, a Series I savings bond with a variable interest rate based on inflation could have a value of $140 or more after 15 years. This shows the importance of understanding the type of bond you have and its interest rate when estimating its worth.Value of a $100 Savings Bond After 15 Years

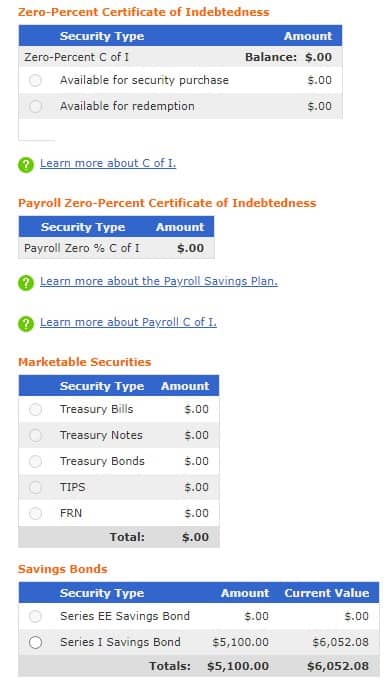

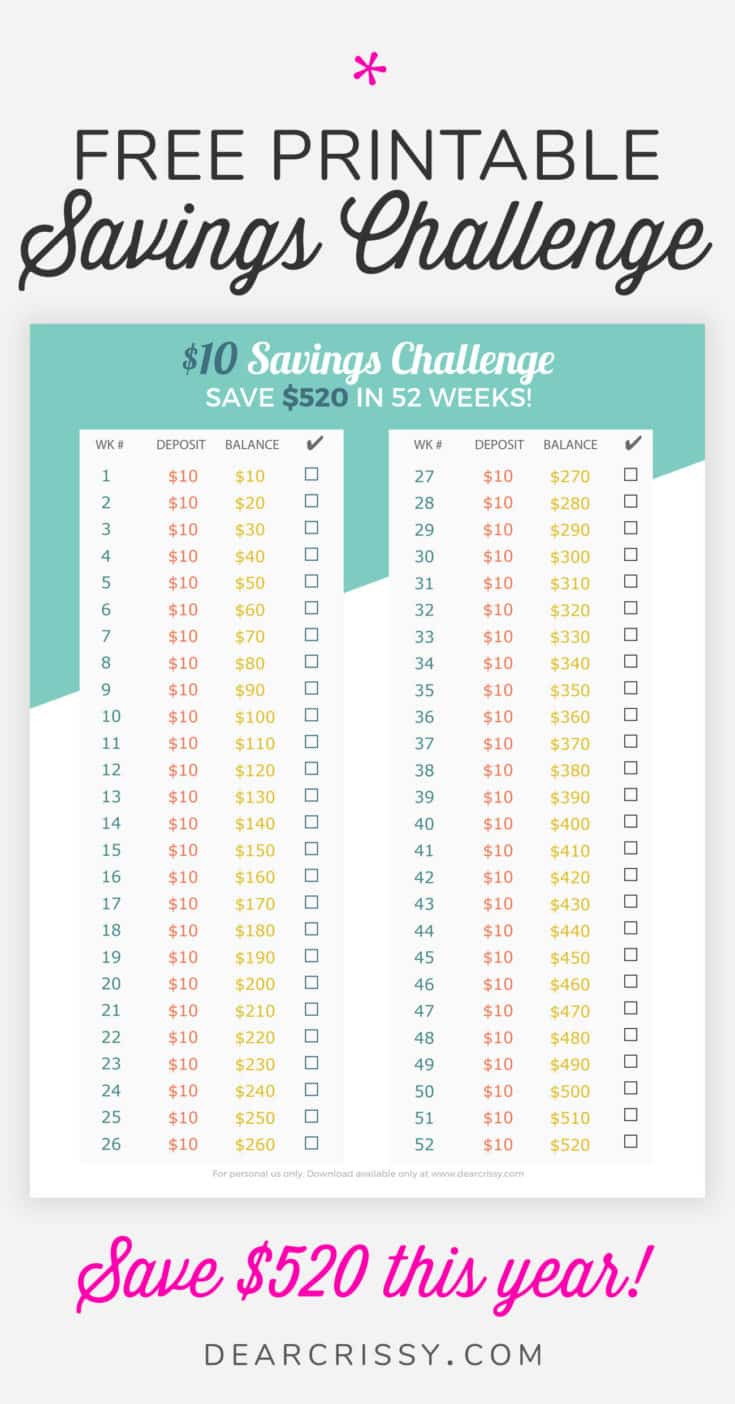

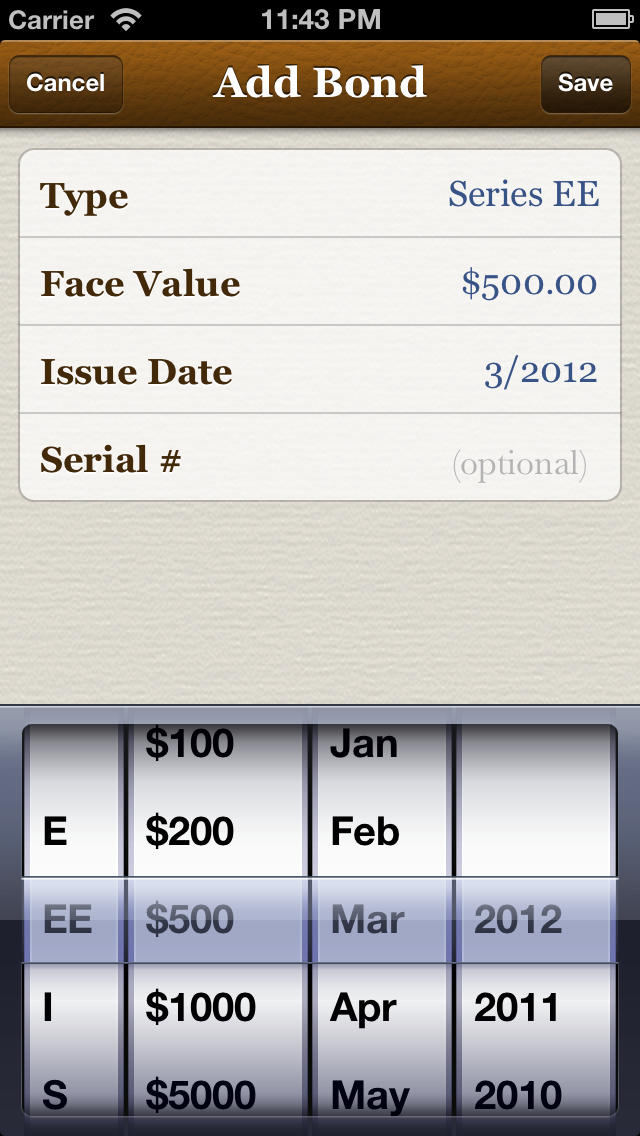

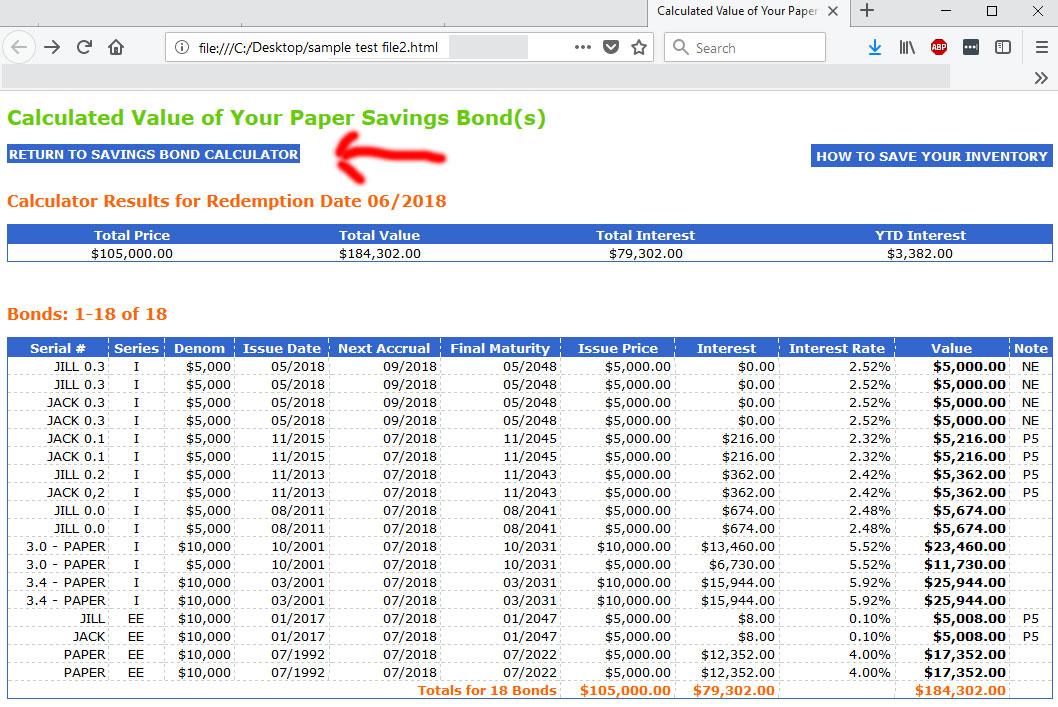

Calculating the worth of a $100 savings bond after 15 years can be a bit complex, as it involves considering the bond's interest rate, the number of years it has been held, and the bond's original purchase price. The easiest way to get an estimate of your bond's worth is to use a savings bond calculator, which can be found on the U.S. Department of the Treasury's website. Simply input the bond's information, and the calculator will provide an estimated value.Calculating the Worth of a $100 Savings Bond After 15 Years

As mentioned, using a savings bond calculator is the most efficient way to get an estimate of your bond's worth after 15 years. The calculator will take into account the bond's interest rate, the number of years it has been held, and the bond's original purchase price to provide an accurate estimation. Additionally, the calculator will also show the bond's current yield, which can be helpful in comparing its value to other investments.15 Year Savings Bond Calculator

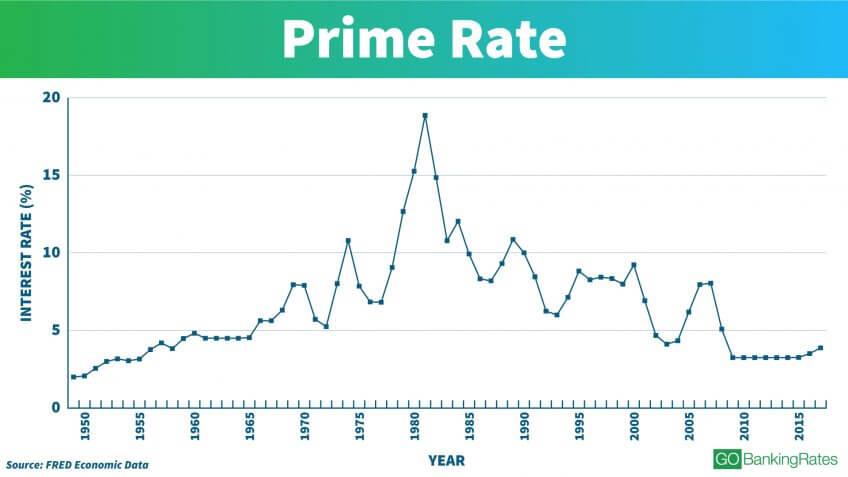

When considering investing in a savings bond, it's essential to understand the potential return after a certain period, such as 15 years. As mentioned earlier, the interest rate of the bond will play a significant role in determining its worth after 15 years. However, other factors, such as inflation and economic conditions, can also affect the bond's return. It's crucial to research and understand these factors before investing in a savings bond.Estimating the Return on a $100 Savings Bond After 15 Years

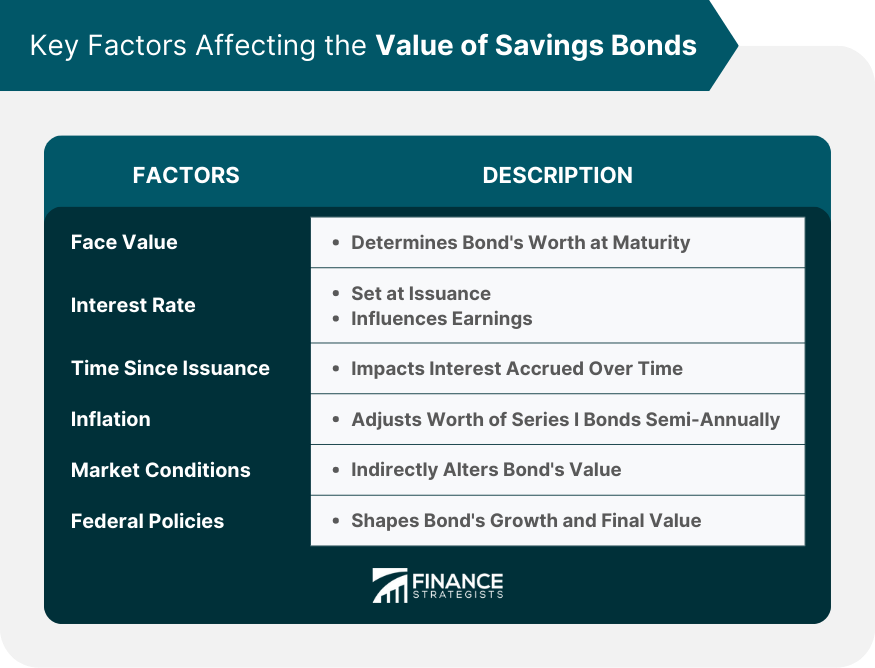

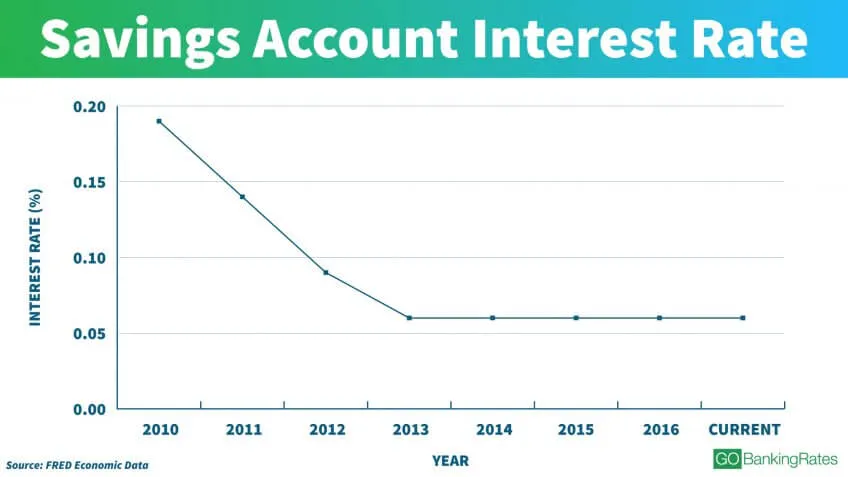

Several factors can affect the value of a $100 savings bond after 15 years. As mentioned, the bond's interest rate and type are crucial factors in determining its worth. However, other factors, such as inflation, economic conditions, and changes in the bond market, can also have an impact. It's essential to stay informed about these factors and their potential effects on your savings bond's value.Factors Affecting the Value of a $100 Savings Bond After 15 Years

The interest rates for savings bonds can change over time, which can affect the value of your bond after 15 years. For example, if you have a Series I savings bond with a variable interest rate, the rate will be adjusted every six months based on inflation. This means that your bond's value after 15 years can be significantly higher or lower than the initial estimate, depending on the inflation rate during that period. It's crucial to stay updated on interest rates and their potential impact on your savings bond.Understanding the Interest Rates for a $100 Savings Bond After 15 Years

When considering investing in a savings bond, it's important to compare its potential worth after 15 years to other investment options. While savings bonds are considered low-risk investments, they may not have the same potential for a high return as other investments, such as stocks or real estate. It's important to weigh the potential return of a savings bond against other investment options to make an informed decision.Comparing the Worth of a $100 Savings Bond After 15 Years to Other Investments

If you already have a $100 savings bond and want to maximize its value after 15 years, here are a few tips to keep in mind:Tips for Maximizing the Value of a $100 Savings Bond After 15 Years

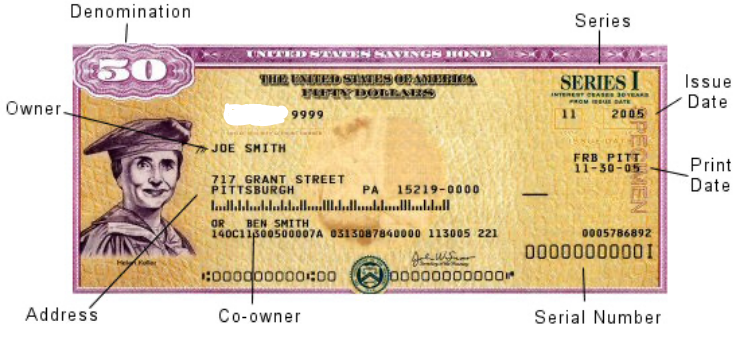

After holding onto your $100 savings bond for 15 years, you may be wondering what to expect when redeeming it. First, it's essential to note that savings bonds cannot be redeemed before they reach their maturity period. Once the bond has matured, you can redeem it at a financial institution or through the TreasuryDirect website. You will be required to provide identification and complete a redemption form. Keep in mind that you may owe taxes on the bond's interest, so it's crucial to consult with a tax professional before redeeming.Redeeming a $100 Savings Bond After 15 Years: What to Expect

The Value of Savings Bonds: Understanding Investment Strategies

/GettyImages-182885962-980f463243df44ba9f5495b7f5fb15c5.jpg)

/what-to-know-about-savings-bonds-4179025-final-9e1dce19b5d44cdf94f8c01e64ac25b2.png)

![Find The Best Airtel 5 Rs Sms Pack Code [Check The Best]](https://www.ussdcode.in/wp-content/uploads/2021/12/Airtel-5-Rs-SMS-Pack-Code.jpg)

![Explore Chick Fil A 30 Nuggets Deal Thursday [Check The Best]](https://www.mashed.com/img/gallery/chick-fil-a-chicken-nuggets-what-to-know-before-ordering/intro-1626287540.jpg)